17 Jan

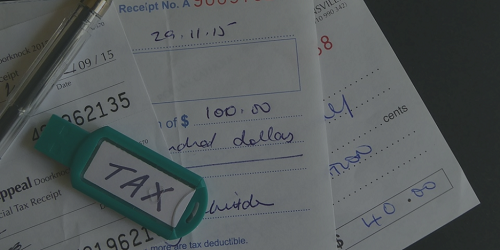

It’s no one’s favorite time of the year. After the New Year, many small business owners start anticipating the dreaded end of the fiscal year, also known as tax season. And while finding the money to pay Uncle Sam can be tough for the cash-strapped small business owner, there are some ways to minimize the burden.

A leader in small business accounting solutions, Accurants is passionate about helping companies manage their money more effectively. Here are 10 lucrative tax deductions for small businesses, based on our team’s years of experience in the field:

1. Labor

If you hire freelancers or contract workers to help out with your business, be sure to write off this cost on your tax paperwork. Additionally, you should make sure to send 1099 forms to any worker in your employ earning $600 or more annually.

2. Rent

Whether you work at home or in an office, you can write off a portion of the cost of your mortgage or rent payment. Just be sure that the space you write off is actually – and only being used for business purposes, or the IRS may come calling.

3. Office Supplies and Equipment

Along with the space in which you do business, the supplies and equipment you use in daily operations are tax deductible. So, save those receipts for computers, printers, paper, and other office products.

4. Utilities

You can’t run a business – or a shop – in the dark. When you fill out your tax return, be sure to record and report costs for utilities, including your cell phone, internet, and electricity.

5. Auto Expenses

Do you drive your own car to meet clients or deliver goods and supplies? If so, you might be able to deduct some of your auto expenses on an annual basis. Accurants can help you track your business mileage, as well as associated costs like tolls and parking fees. Use Accurants mileage log to keep track of the business miles and be sure to capture all the details of the trip including the business purpose. Accurants automatically calculates the business mileage expenses and displays in the Schedule C (Profit and Loss) statement.

6. Insurance

As a small business owner, you might be paying the full cost of your own health insurance rather than receiving it from an employer or spouse’s employer. If so, you can deduct that cost on your tax paperwork. Additionally, you can deduct costs associated with business insurance, accident insurance, and even life insurance in some cases.

7. Retirement

Self-employed workers don’t always have access to 401ks. However, you can save money for retirement in an SEP IRA and write off the contribution on your income tax statement.

8. Debts

Small business owners often find themselves struggling to recoup money from clients who request products and services only to skip out on the bill. Luckily, they can deduct a portion of these debts from their taxable income.

9. Fees

Many professionals pay money to be part of certain groups or associations. Small business owners can deduct lawyer fees along with those paid to tax professionals and other associations.

10. Marketing

If you spent money advertising your products and services this year, be sure to write it off on your tax statement. Applicable marketing products include business cards, brochures, and even radio ads.

Contact Accurants for Your Tax Planning Needs

Accurants’ state-of-the-art, cloud-based software system is designed to make small business tax preparation as painless as possible. You can count on us to help with sales tax calculations, track 1099 forms, and generate filled-out Schedule C forms. To learn more about our services, call today or contact Accurants online for a free trial.